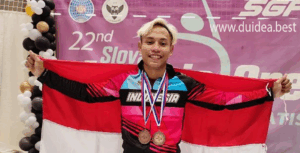

Atlet Bora Tarhan dan Mert Efe Kilicer Meraih Medali di Kejuaraan Internasional

Pendahuluan Atlet Bora Tarhan Pada kejuaraan internasional terbaru, dua atlet berbakat dari Turki, Bora Tarhan…

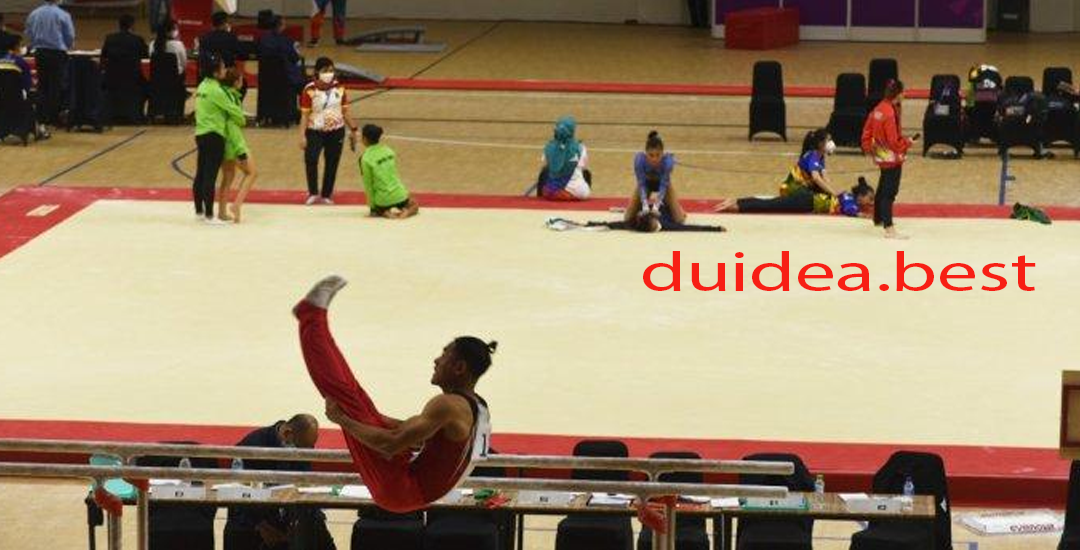

Meiyusi Ade Putra dan Keahliannya dalam Nomor Palang Sejajar dan Kuda Pelana Artistik Putra

Pendahuluan Meiyusi Ade Putra Dalam dunia olahraga senam artistik, setiap atlet memiliki keunggulan dan keunikan…

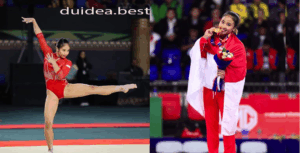

Sunisa Lee: Pesenam Putri Amerika Serikat yang Memukau di Olimpiade dengan Keanggunan

Pendahuluan Sunisa Lee panggung bagi banyak atlet dari seluruh dunia untuk menunjukkan bakat dan perjuangan…

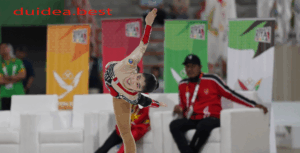

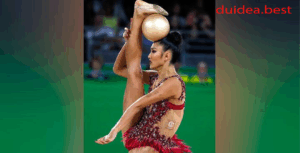

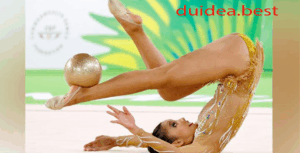

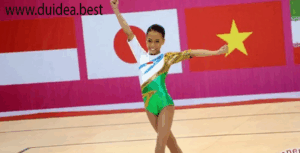

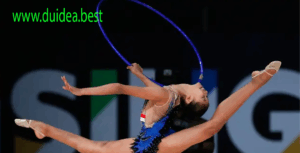

Nabila Evandestiera: Pesona dan Ketangguhan Pesenam Indonesia

Pendahuluan Nabila Evandestiera Indonesia terus menunjukkan eksistensinya di dunia olahraga, khususnya dalam cabang senam ritmik.…

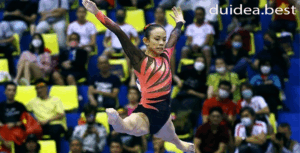

Thanh Tung Le: Bintang Pesenam Vietnam yang Menjanjikan

Pendahuluan Thanh Tung Le Dalam dunia olahraga senam, nama Thanh Tung Le mulai dikenal luas…

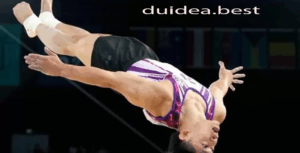

Senam Trampolin: Olahraga Akrobatik yang Menggabungkan Keseimbangan dan Kecepatan

Pendahuluan Senam trampolin adalah salah satu cabang olahraga akrobatik yang memadukan keindahan gerakan, kekuatan, keseimbangan,…

Fan Yilin: Bintang Gemilang dari Dunia Senam Artistik China

Pendahuluan Fan Yilin: Bintang Gemilang dari Dunia Senam Artistik China. Fan Yilin adalah salah satu…

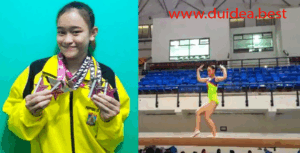

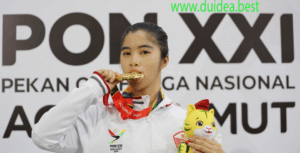

Atlet Senam Aerobik DKI Jakarta, Krischayani Kurniawan, Raih Medali Emas di PON

Pendahuluan Atlet Senam Aerobik DKI Jakarta Dalam ajang Pekan Olahraga Nasional (PON) terbaru, dunia senam…

Mert Efe Kilicer: Atlet Berbakat yang Mengklaim Medali Perak dan Perunggu

Pendahuluan Mert Efe Kilicer Dalam dunia olahraga internasional, keberhasilan atlet tidak hanya diukur dari medali…

Jutta Verkest, Peserta dari Belgia, Tampil Memukau di Babak Kualifikasi Nomor Balok

Pendahuluan Jutta Verkest Pada ajang Kejuaraan Dunia Senam Artistik yang berlangsung baru-baru ini, salah satu…